Cardano (ADA)’s price is not doing well as it falls below $0.8. As of the time of writing, the crypto has lost 5.7% in value from its intraday high of $0.77 and now trading at $0.7325. It has lost over 25% this month.

The downward trend is linked to slow network activity and a bearish technical trend, which may contribute to additional declines in the next few days.

In the last quarter, ADA underperformed compared to Bitcoin (BTC). Based on the daily chart via trading view, the price of ADA has dropped by 32% while that of BTC dropped by just 2.3%.

This has made investors less sure of the cryptocurrency. The ADA/BTC ratio once saw a massive 193% surge between November and December 2024, reaching a multi-year high on December 3. But then it fell by 45%, to its lowest point in 12 weeks, on February 3.

A big reason for this price drop is a decline in activity on the Cardano network. Right now, fewer people are using the blockchain, which means there is less demand for ADA.

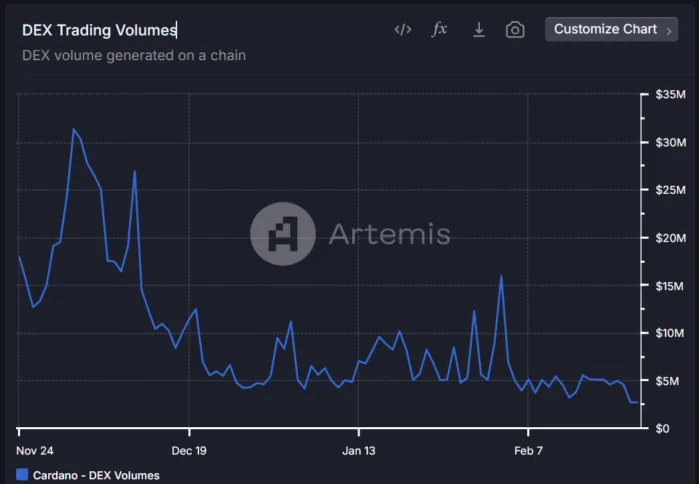

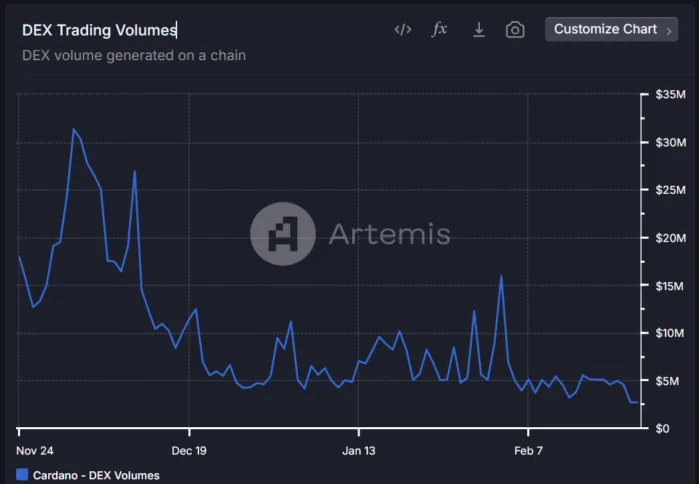

Moreover, the trading volume on Cardano’s decentralized exchanges (DEX) has fallen sharply, from $31.3 million on December 2 to just $2.7 million on February 23

Meanwhile, the number of active addresses took a deep dive from 113,500 in late November to 25,900 as of yesterday. In addition, the total value locked (TVL) in the Cardano ecosystem has dropped from $701.4 million last December to approximately $366 million today.

Looking back at the chart, we will see a bear flag pattern that was just confirmed today when the price broke below $0.77. If the price goes below this point, the next targets are $0.65 and $0.512.

If the sell-off continues, ADA can fall further to $0.4517, which is 41.3% lower than its current value.

The relative strength index (RSI), which measures momentum, has crossed the 50% average to 42. This means that the selling pressure is increasing. However, if ADA manages to climb back above $0.77, it could avoid further losses and remain stable for now.

Also Read: Solana Dips Below $160 as FTX Unlock Sparks Sell-Off Worries