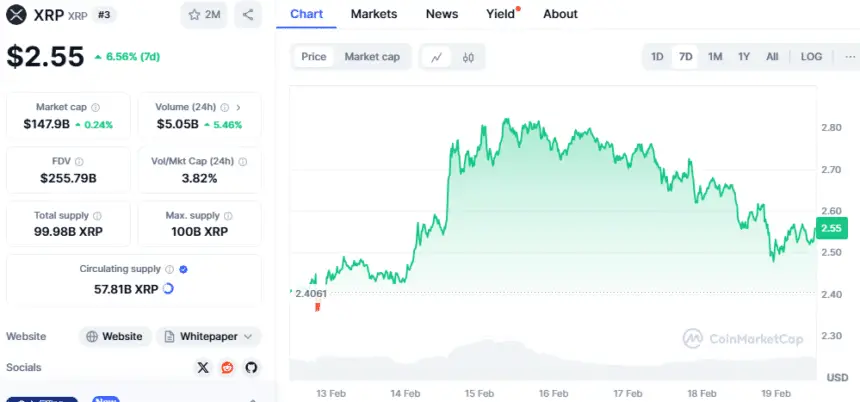

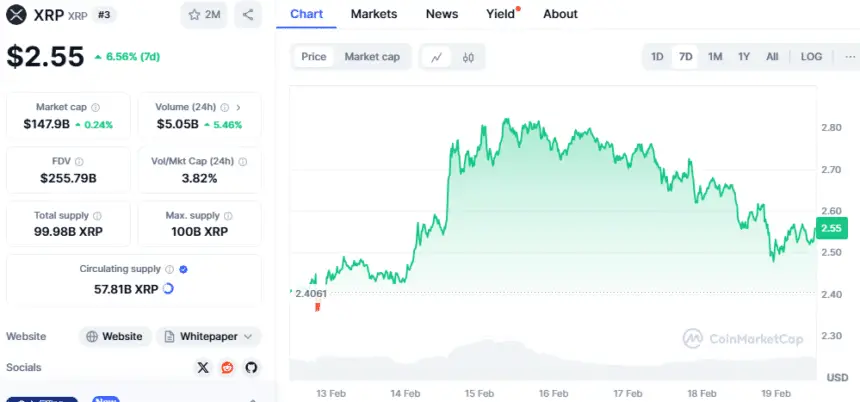

XRP has been on a tear, surging almost 7% in a week as excitement grows over a possible XRP ETF. It’s currently priced at $2.55, with a market cap of $147.9 billion, while trading volume has spiked 5% in the past 24 hours to $5.05 billion.

The market is buzzing, and investors are locking in as speculation grows that the SEC might finally be coming around on crypto ETFs.

The big news came on February 13, when the SEC officially acknowledged Grayscale’s applications for spot XRP and Dogecoin ETFs. This kicked off a 240-day review process, meaning we could see a final decision by mid-October. Once these filings are entered into the Federal Register, the countdown begins. Many see this as a sign that the SEC might be softening its stance on crypto, which has only added fuel to the fire.

Traders aren’t wasting any time betting on the outcome. The Polymarket prediction market now has the odds of a Ripple ETF approval in 2025 at 78%, showing just how confident people are. Analysts are throwing around big numbers, with some saying XRP could hit $8 if an ETF gets the green light. While that’s still speculation, XRP’s momentum is undeniable.

But not everyone is celebrating. Edoardo Farina, founder of Alpha Lions Academy, pointed out a growing problem as many investors might get priced out as XRP keeps climbing.

Right now, you need 2,500 XRP (around $6,500) to be in the top 10% of holders. A few months ago, that number was 3,000 XRP for just $1,500. The rapid price jump is making it tougher for smaller investors to stay in the game.

Farina believes that if XRP continues this volatility, up to 95% of current holders might struggle to hold onto their tokens. However, with market volatility and financial pressures, not everyone will be able to hold on. With ETF speculation gaining traction and XRP maintaining strong momentum, the coming months could be a turning point.