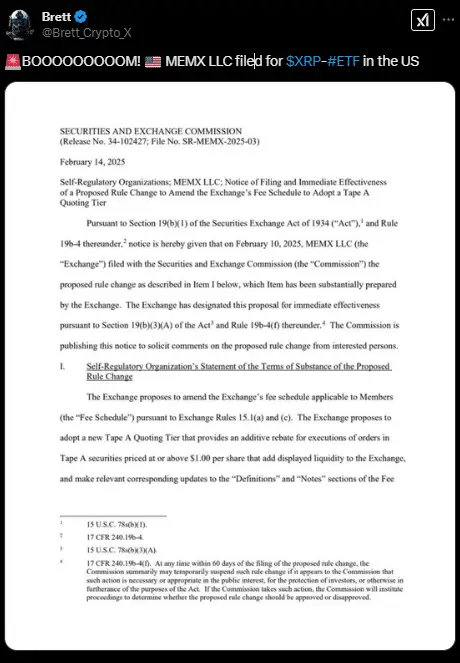

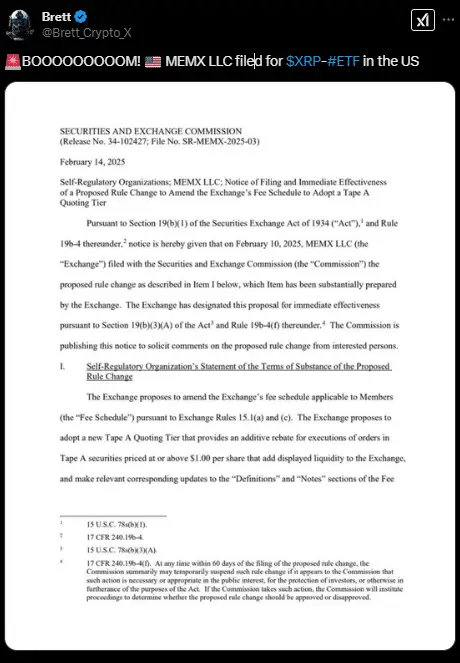

MEMX, a securities exchange based in the U.S., has filed with the Securities and Exchange Commission (SEC) to list an XRP exchange-traded fund (ETF) under Commodity-Based Trust.

This means XRP would be classified similarly to Bitcoin and Ethereum ETFs, which were approved last year. The filing was made yesterday, February 17, as more crypto-related ETFs seek regulatory approval.

Meanwhile, the SEC has a complicated history with XRP. In 2020, the agency sued Ripple, the company behind XRP, claiming it sold unregistered securities. But in August 2023, a U.S. judge ruled that XRP itself is not a security, though certain sales could be considered securities transactions. This ruling has given these exchanges the required moral support to push for an XRP ETF.

MEMX is not alone in doing this. Many other exchanges are also filing for XRP ETFs. One of the most recent is Cboe BZX Exchange. On February 6, 2025, it submitted a request to list four spot XRP ETFs, including the 21Shares Core XRP Trust. The SEC acknowledged the filing on February 14, which means it is now under review.

Meanwhile, Grayscale Investments is looking to convert its existing XRP Trust into an ETF. Its filing has been acknowledged by the SEC as of now.

Moreover, the interest in ETFs is surging. After the SEC approved the Bitcoin ETF early last year, different firms began submitting for ETFs in other cryptocurrencies like Solana, Litecoin, and even memecoins such as Dogecoin (DOGE), and President Trump recently launched memecoin (TRUMP). Even ETF issuers are also working on new features like staking options and in-kind redemptions.

However, the recent change in the U.S. political environment may play a role in the SEC’s next decision. The president won the election last year, and he has promised to make America the “world’s crypto capital.”.

He has also appointed new pro-crypto figures to key positions, which could mean a friendlier stance on crypto ETFs.

On February 14, 2025, the first-ever spot crypto index ETF, Hashdex Nasdaq Crypto Index U.S. ETF, started trading on Nasdaq. This ETF gives investors exposure to multiple digital assets at once.

Also Read: 78% Chance of XRP ETF Approval by SEC in 2025 Polymarket