Uniswap is one of the most used decentralized applications (dApp) among crypto traders and it has been leading the industry since years. This trading platform has played a key role in the development and growth of the decentralized finance (DeFi) ecosystem.

As of latest data, Uniswap is generating a monthly trading volume of over $2.88 trillion and it has a total value locked (TVL) of $3.24 billion, which once topped to $10 billion. This puts it among the largest dApps in crypto space. While its recently making a wave of headlines, let’s have a further dive into it to find out how it works, its essential parts and how it is used;

What is Uniswap

Uniswap is a decentralized exchange (DEX) that enables trading of crypto assets without going to exchanges, where users are required to give personal information and complete KYC in order to be able to trade. It allows to trade one cryptocurrency in exchange for another in a secure, quick and decentralized manner. On uniswap, trading is also called swapping as one asset is essentially swapped with another asset.

How it works

While centralized crypto exchanges like Binance or Coinbase use orderbook to match users’ trades, Uniswap employs a novel mechanism of Automated Market Makers (AMM). This method uses liquidity pools for executing orders where two or more assets are locked within a smart contact. When a trader places an order (for example swapping 1 ETH into USDT), the AMM will trade 1 ETH for USDT at standard market rate from the ETH-USDT liquidity pool.

These liquidity pools constantly function to update the price of assets everytime a trade is executed. For the liquidity pool, when ETH is sold, the amount of USDT will increase hence decreasing ETH price and if ETH is purchased, USDT amount will decrease, essentially setting a higher price for ETH.

Launch & History

Launched in 2018, Uniswap quickly became popular among crypto traders and it did not require to go through KYC or any mandatory sign-ups processes. Users found it easier to trade in Uniswap than crypto exchanges like Coinbase or Binance at the time. It was developed by Hayden Adams and he is currently CEO of the Uniswap Labs, the development arm looking after Uniswap Protocol.

Uniswap Timeline

Here is the timeline of Uniswap, from its launch in 2018 to February 2024;

2018: Launch of Uniswap

- November 2018: Uniswap V1 is launched on Ethereum with introducing Automated Market Maker (AMM) model, allowing decentralized token swaps without relying on order books.

2020: Uniswap V2 & UNI Token Launch

- May 2020: Uniswap V2 is released, featuring direct ERC-20 to ERC-20 token swaps, improved price oracles and flash swaps functionality.

- September 2020: Launch of UNI token, the native token of Uniswap protocol.

2021: Uniswap V3 Launch

- May 2021: Uniswap V3 launches with a concentrated liquidity mechanism where liquidity providers (LPs) can allocate funds within specific price ranges. It also introduced multiple fee tiers, offering different fees based on volatility. Another significant development was NFT-Based LP Positions, representing unique liquidity positions as NFTs.

- July 2021: Expansion to Layer 2 solutions Optimism and Arbitrum, reducing transaction costs and improving speed.

2023: Uniswap V4 Announcement

- June 202: Announcement of Uniswap V4, proposing “Hooks” framework that allow custom AMM logic in liquidity pools. Also introduced Singleton Contract, which aims to reduce gas costs.

2024: Unichain Introduction

- October 2024: Uniswap Labs unveils Unichain, an Ethereum-based Layer 2 blockchain built on the Optimism Superchain, designed to offer faster transactions and improved cross-chain liquidity.

2025: Uniswap V4 and Unichain Mainnet Launch

- January 2025: v4 Launch: Uniswap V4 goes live with Hooks and Significant Gas Cost Reductions, making pool creation 99.99% cheaper and reducing costs for multi-hop swaps.

- February 2025: Unichain Mainnet launch: Near-instant transaction finality with block times optimized to 200-250 milliseconds. Enhanced Cross-Chain Interoperability: Facilitating seamless liquidity across multiple chains.

Key Developments from Uniswap

UNI Token

UNI is the native token to Uniswap that is used for various tasks within the protocol’s ecosystem. It was launched in 2020 as an ERC-20 token on Ethereum blockchain. Initially, the token was rewarded to liquidity providers but it is now available to purchase across multiple markets. UNI token now also plays a crucial role in Uniswap governance which helps in introducing new developments and advancements to the platform.

Unichain

Unichain is the native blockchain for Uniswap. It is a layer 2 network, solely focusing on improving functionalities of the Uniswap decentralized exchange platform. Unichain mainnet went live on February 11 after one year of continuous development.

One of the most enticing features of Unichain is its 1-sec block time and 95% reduced gas fee. With its efficient architecture, Unichain aims to drive mass adoption by making decentralized trading more accessible and cost-effective for users worldwide.

Uniswap v4

Uniswap v4 is the newly launched iteration by the Uniswap protocol that introduces several enhanced features and functionalities, compared to v3. As one of the key developments, this version introduces “hooks” which are customizable smart contracts functions. It essentially helps in employing advanced trading strategies, dynamic fees and onchain limit orders. This version also brings major changes to liquidity pools with it reducing fees by 92% for creating new pools.

Another significant functionality Uniswap v4 brings is “singleton” pools architecture. This concept combines all liquidity pools in a single smart contract and makes token swap more affordable. With all these new functions, v4 not only upgrades Uniswap’s capabilities but also enhances the overall user experience (UX) within the DeFi ecosystem.

Difference: v3 Vs v4

| Uniswap v3 | Uniswap v4 | |

|---|---|---|

| Liquidity Management | Uses a concentrated liquidity mechanism which allows liquidity providers to specify price ranges. | Uses optimized concentrated liquidity mechanism, combining with singleton model to reduce gas. |

| Core Infrastructure | Each liquidity pool has a separate smart contract. | All liquidity pools function under a common smart contract. |

| Customization | No built-in customization for liquidity pools. | Introduction of “hooks” enables customization of liquidity pools. |

| Transactions | Each transaction requires multiple calls, essentially increasing gas consumption. | Flash Accounting feature bundles all external transactions and settles them at the end, reducing gas consumption. |

| L2 Support | Supports Layer 2 networks with limited optimization. | Fully optimizable even on Layer 2 networks. |

How to use Uniswap

Uniswap is used for various purposes besides just swapping crypto assets, such as yield farming, launching liquidity pools, launching initial market for tokens, etc.

How to swap tokens on Uniswap (ETH to USDT)

To swap crypto assets on Uniswap, one must have a crypto wallet and funds in the respective blockchain. Followings are the steps:

Step 1: Open Uniswap dApp

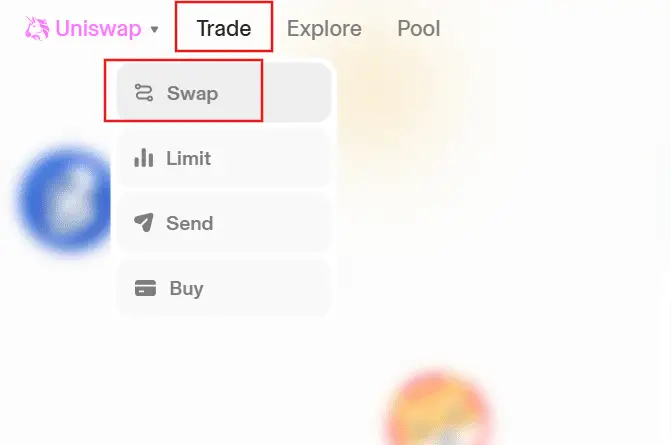

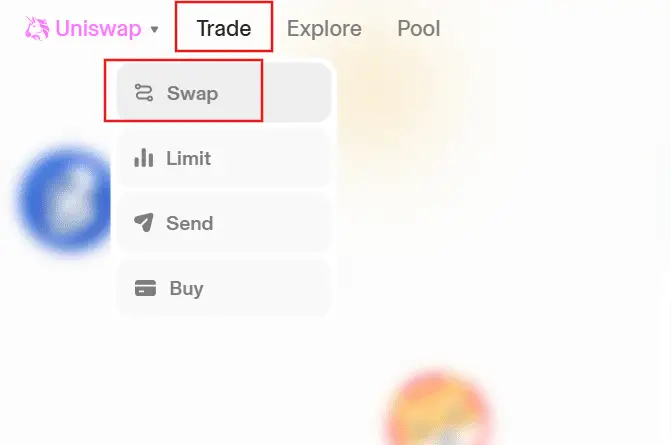

Go to Uniswap dApp and click on “Trade” and opt for “Swap.”

Step 2: Connect Your Wallet

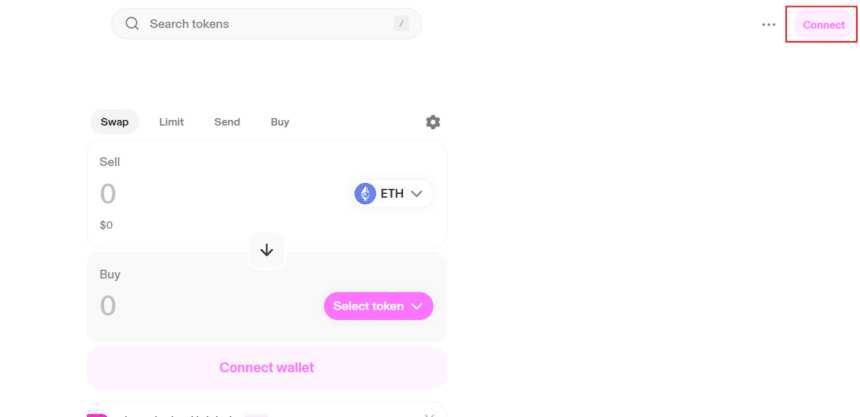

Click on the ‘Connect’ button on the top right corner to connect your wallet.

Step 3: Choose Assets

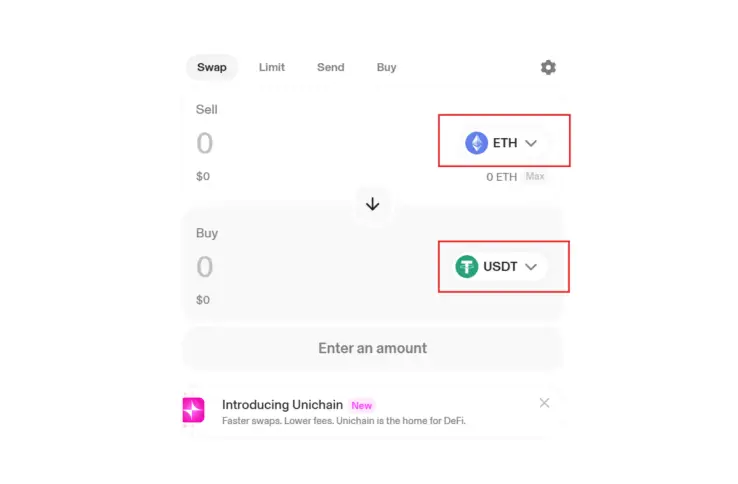

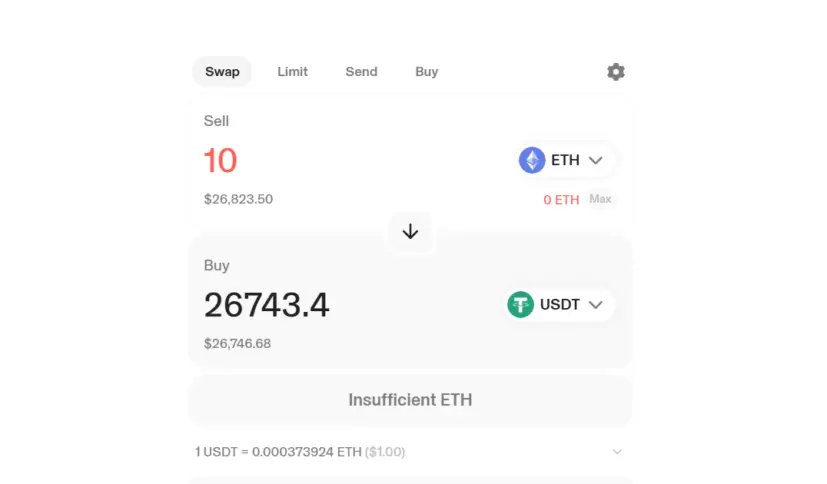

Choose which asset you want to swap from your wallet. To swap ETH in USDT, select ETH in the first input box and USDT in second.

Step 4: Enter Amount

Enter the amount of ETH you want to swap to USDT and make sure you have enough ETH in balance to cover gas fees.

Step 5: Verify Details and Swap

Now verify all the details and click on the ‘Swap’ button.

Step 6: Confirm Transaction

Now it will automatically lead to the Metamask wallet from where you will need to confirm and complete the transaction.

Once one, your ETH will be swapped into USDT and it can be seen in Metamask wallet.

How to add liquidity in Uniswap LP

Adding liquidity in Uniswap is quite a complex process but it’s not as hard as newcomers find. All you need is funds and commitment to a particular liquidity pool in which you want to provide liquidity.

Why to add liquidity in Uniswap?

There could be various reasons for providing liquidity, such as for earning yields, creating liquidity markets or launching trading for new tokens. By adding liquidity to new or existing liquidity pools, you become Liquidity Provider (LP) and earn trading fees everytime someone trades underlying assets on Uniswap.

Adding Liquidity to Uniswap Liquidity Pools

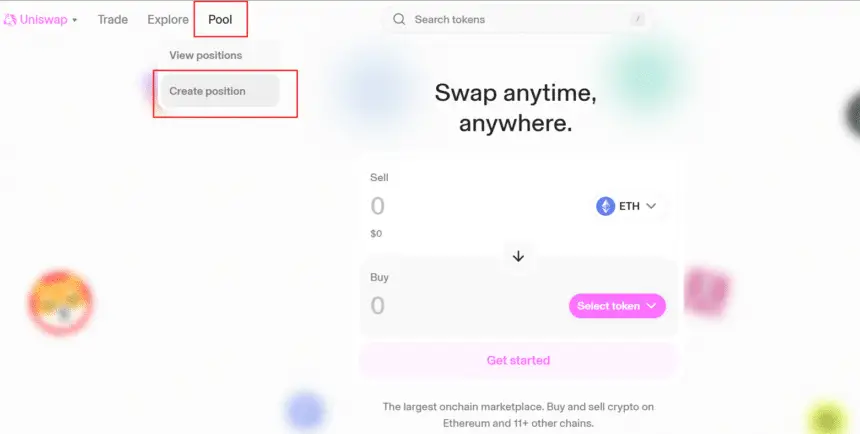

Step 1: Open Uniswap dApp & Go To Pools

Go to Uniswap dApp and click on “Pool” and opt for “Create Position.”

Make sure that your wallet is connected. If not, connect via just clicking on the button ‘Connect’ at the top right corner.

Step 2: Enter Pool Details

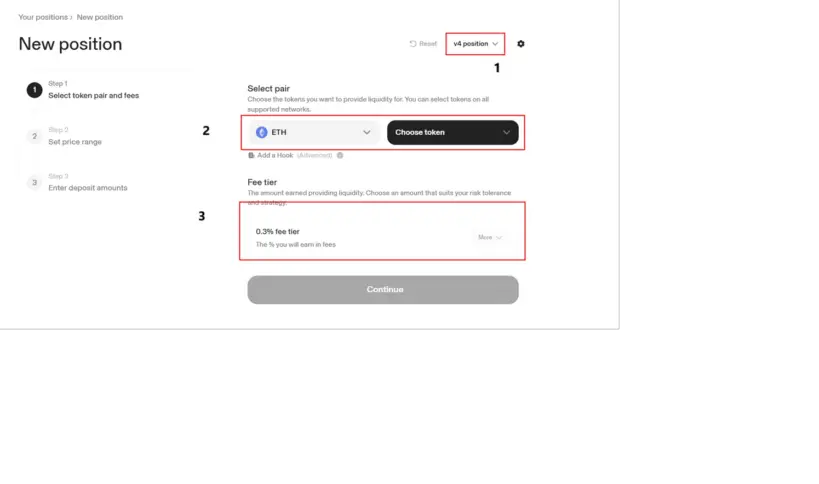

Now enter all the necessary details.

- Choose whether you want to add liquidity to Uniswap v2, v3 or v4.

- Choose on which asset pair you want to add liquidity. (For example; ETH and USDT)

- Select ‘Fee Tier’ as per your convenience and click on ‘Continue’ button.

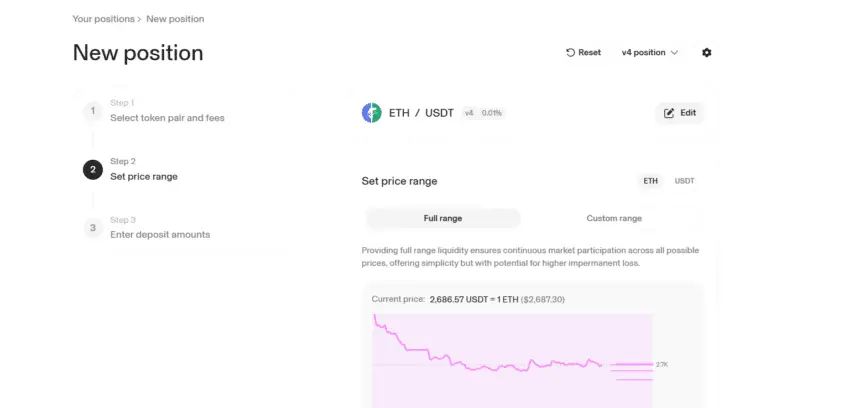

Step 3: Set Price Range

You can now set either full price range or custom range where your assets would be utilized. Once set, click on ‘Continue.’

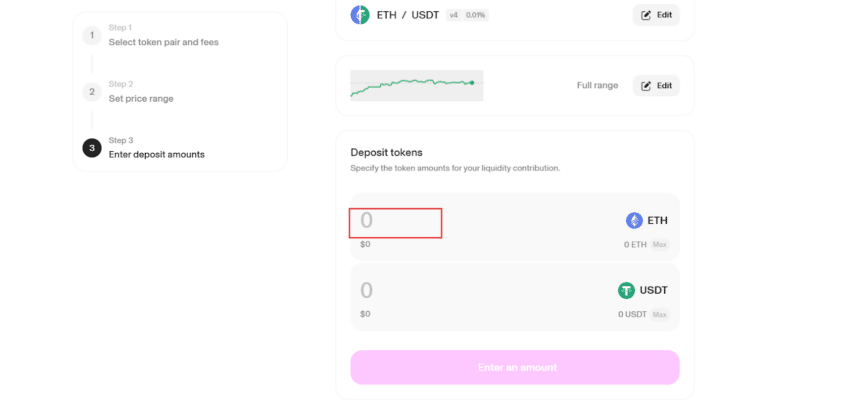

Step 4: Deposit Funds

Now is the time to add actual funds. Make sure whatever amount you are adding, it needs to be equivalent.

For example, adding 10 ETH would also need to have 10 ETH worth of USDT tokens. If ETH price is $2,500, you must have $25,000 of USDT tokens in order to be able to add funds in the liquidity pool.

Step 5: Add Liquidity

Now click on the “Add Liquidity” button and complete the transaction.

And that’s it, your funds are now successfully added to liquidity pools. Now everytime someone trades on this pool, you will get commission in fees which can be claimed from dApp > Pool > Your Positions.

Final words

Uniswap is one of the best decentralized trading platforms and it has been continuously developing to enhance users’ trading experience. While there are now tens of competitors, Uniswap still stands as a leader among all despite being one of the earliest DEX platforms. From swapping tokens to yield farming, all these decentralized trading functionalities can be seamlessly accessed on Uniswap.