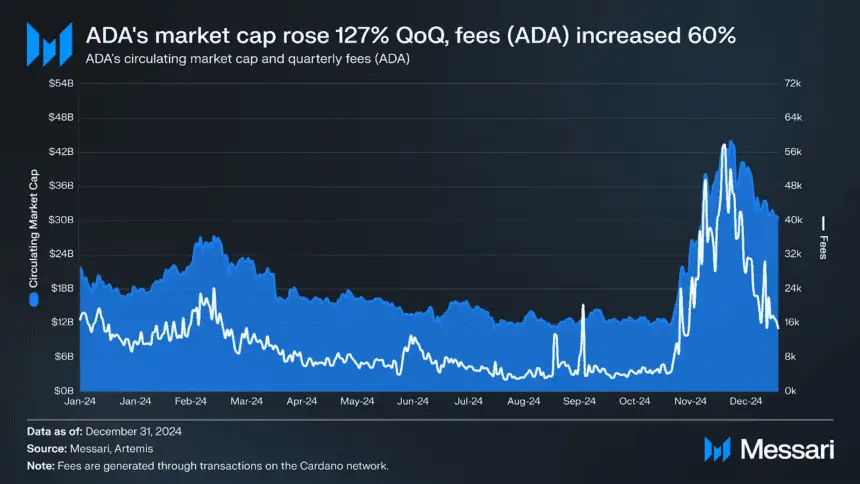

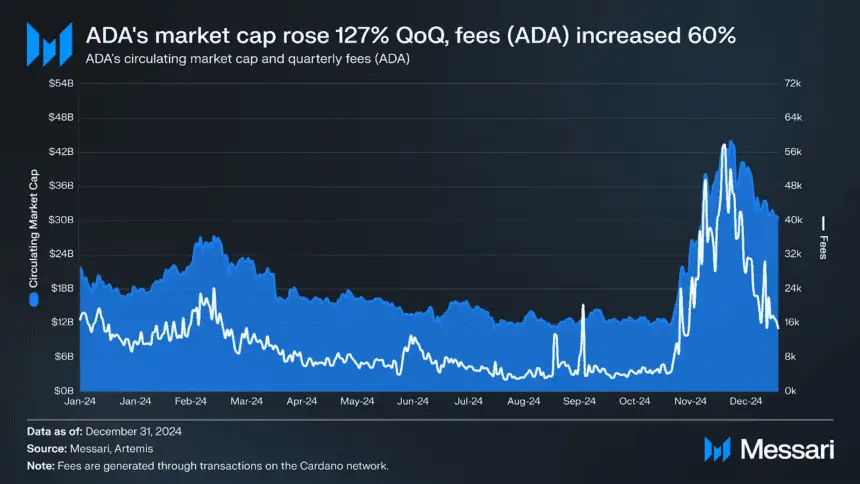

The fourth quarter of 2024 was no less than a success for Cardano (ADA) with the price going as high as 126% and the market cap reaching $30.3 billion.

As a result of this, the token pushed up from 11th to 9th largest cryptocurrency by circulating market cap. The rally happened around the same time when the U.S. election took place, which helped the overall market surge.

According to a recent report from Messari, the rate of transaction fees on the Cardona network rose to 254% QoQ to $1.8 million. This is even 95% higher compared to the same period the previous year.

But even with the growth, the average transaction fee in ADA fell slightly by 2% to 0.34 ADA, which means the network handled the extra activity well.

In addition, daily volumes were up 65% at 71,500, and active addresses were up 58% at 42,900. At the same time, average USD transaction fees were up 80% at $0.23 as ADA’s price rose.

Moreover, the total value locked in DeFi (TVL) increased by 13% from last quarter to $231.6 million. Liquid Finance overtook the top position, growing by 141% to $113.6 million, surpassing Minswap.

Meanwhile, Minswap still saw 69% growth, reaching $98.9 million in TVL. Smaller protocols like Splash Protocol and Aada had massive growth, rising 253% and 105% QoQ, respectively.

Decentralized exchanges (DEXs) on Cardano also showed a good performance. Daily trading volume rose 271% QoQ, reaching $8.9M.

Minswap led the sector by over 200,000 traders and got a total volume of $3.1 billion. WingRiders plus SundaeSwap gave support to the overall DEX trading volume and increased by 40% YoY.

Cardano’s stablecoin market cap increased by 66% QoQ. The most popular stablecoins on the network, iUSD and DJED, grew by 20% and 41%, while MyUSD increased by 17%. However, USDM was the only one to drop, falling by 5%.

Also Read: Dave Portnoy Makes $258k in GREED Memecoin, Launches GREED2